The landscape of financial crimes, decentralized finance, and digital asset transactions risks is undergoing a critical transformation, poised for a dose of technological transformation. Concurrently, with the rising adoption of cryptocurrencies, blockchain analytics, and the advent of concepts like December 21, the financial crime risk assessment industry is seeing rapid changes. According to Arctic Intelligence, global financial trends and digital decentralized finance platforms are redefining the parameters of financial crime risk assessments.

Artificial intelligence (AI) and machine learning are at the forefront of enhancing these assessments and aiding in the preemptive detection of potential threats or anomalies. AI’s predictive analytics promise to predict potential threats ahead of their materialization, thus allowing for preemptive action. Similarly, real-time data dynamics are improving the accuracy of the Dynamic Risk Scoring process.

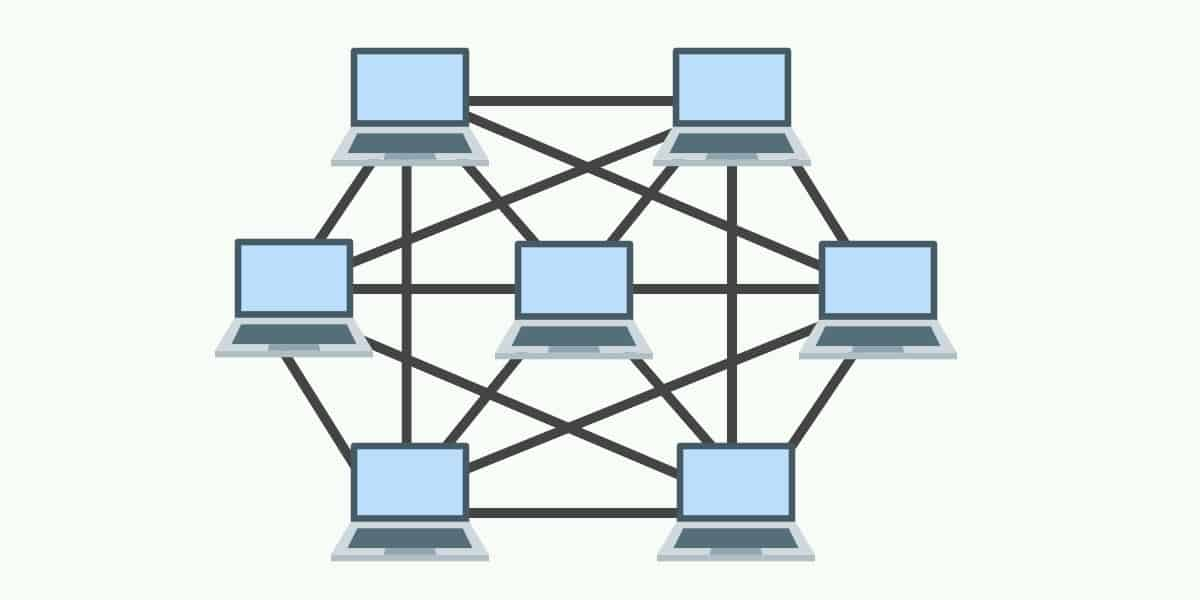

This is complemented by advanced AI applications that can identify subtle behavioral anomalies that often signal financial crime activities. In the context of cryptocurrency and decentralized finance (DeFi) platforms, the sector is poised for increased regulation. Governments are keen on imposing stricter controls on virtual asset service providers and the DeFi ecosystem. Here, advanced blockchain analytics will play a pivotal role in tracing digital asset transactions, thus helping combat money laundering and sanctions evasion.

Organizations are expected to develop specialized frameworks tailored to the unique risks presented by these decentralized platforms. On the other side of the spectrum, the globalization of financial systems highlights the need for data security and privacy compliance. Dublin-based Dataships, a data privacy software and services company, has closed a €6. 8 million Series A funding round led by Osage Ventures Partners with participation from Lavrock Ventures and the Urban Innovation Fund.

The funding will accelerate Dataships’ mission to help merchants drive revenue growth while maintaining complete data privacy compliance. In conclusion, the financial crime risk assessment, digital asset transactions, and data privacy compliance landscapes are undergoing significant transformations driven by global financial trends, technological advancements, and digitalization.

As we enter 2025 and beyond, these shifts are poised to reshape the financial crime risk assessment and data privacy landscapes, impacting organizations, individuals, and regulatory bodies alike.